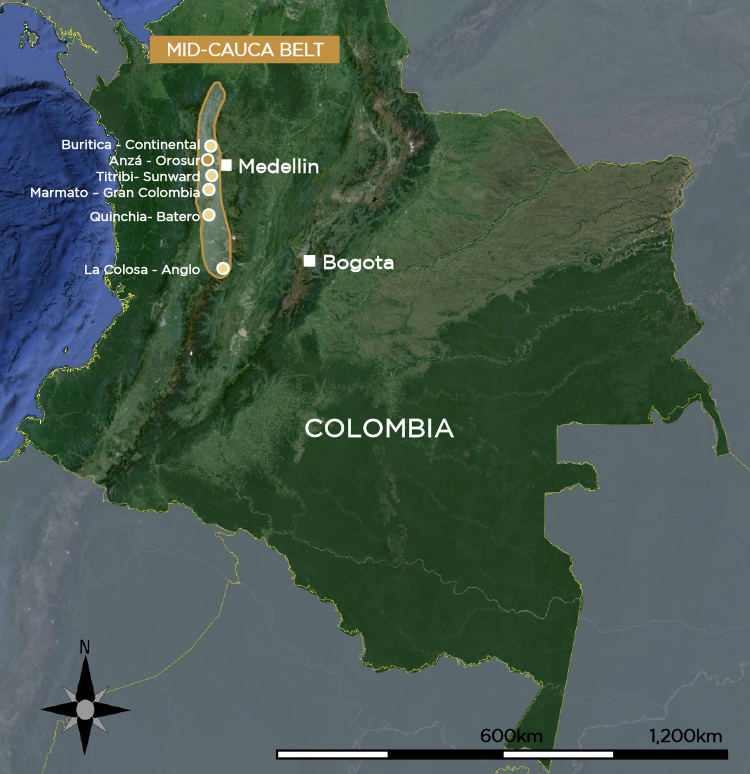

Newmont Mining (NYSE: NEM) (TSX: NGT), the world’s largest gold producer, and Canada’s Agnico Eagle (TSX, NYSE: AEM) have formed a 50-50 joint venture in Colombia to explore the Mid-Cauca belt, in the country’s northwest.

The partners will focus on the Anzá gold project, in which Newmont has earn-in rights, as well as other prospective gold targets of district-scale potential in Colombia.

Newmont reached a three-phase deal with Orosur Mining (TSX, AIM:OMI) in 2018, which granted it the right to earn up to a 75% stake in the Canadian junior’s Anzá project.

The asset, comprising contracts and applications totalling 200 km2, is located 50 km west of Medellin and 60 km south from Zijin Mining’s Buritica operation.

“Agnico Eagle has been actively looking at Colombia for some time, and this low-cost entry is consistent with our exploration strategy,” senior VP exploration Guy Gosselin, said in a separate statement.

The executive added the partnership was also in line with the company’s existing investment in Royal Road Minerals (TSX-V: RYR), in which it has a 19.9% stake.

Agnico will sole fund the joint venture until it equals Newmont’s previous investment in the Anza project of about $2.9 million. After that, the parties will continue funding exploration activities on a 50-50 basis.

Newmont and Agnico Eagle Mines have announced a joint venture to explore the Anzá project and other prospective “district-scale” gold targets in Colombia.

,

Comments are closed, but trackbacks and pingbacks are open.